PNB Share Price Target 2025-2030-2035-2040

Introduction

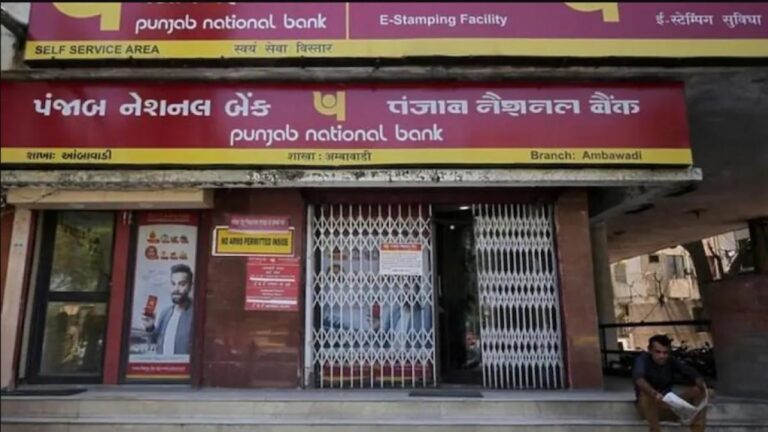

PNB (Punjab National Bank) is the country’s first indigenous bank, with a history spanning more than 125 years. Owned by the Government of India, it boasts over 18 crore customers and operates 12,609 branches nationwide. The bank’s services encompass credit cards, consumer banking, corporate banking, finance and insurance, investment banking, mortgage lending, private banking, private equity, and wealth management technology.

In the realm of financial markets, forecasting plays a pivotal role in decision-making processes. As investors navigate the complexities of the stock market, having insights into future share prices can be instrumental. This article delves into the analysis and predictions for PNB’s share price target in 2025. Through comprehensive research and expert opinions, we aim to provide valuable insights to investors seeking clarity and foresight in their investment strategies.

PNB Share Price Target 2025

| 2025 | Share Price Target |

|---|---|

| January | ₹149.95 |

| February | ₹140.20 |

| March | ₹146.72 |

| April | ₹148.15 |

| May | ₹152.67 |

| June | ₹151.75 |

| July | ₹152.92 |

| August | ₹149.25 |

| September | ₹158.89 |

| October | ₹161.70 |

| November | ₹164.22 |

| December | ₹166.32 |

According to current market analysis, the company’s stock price can reach ₹166.32 per share by the end of 2025.

- The averaged price 194. Punjab National Bank at the end of the month 197 Rs, the change for December 7.1%.

- PNB share target for January 2025. In the beginning at 197 Rs. Maximum 225, minimum 191. The averaged price 205. Punjab National Bank at the end of the month 208 Rs, the change for January 5.6%.

- PNB share price prediction for February 2025. In the beginning at 208 Rs. Maximum 229, minimum 195. The averaged price 211. Punjab National Bank at the end of the month 212 Rs, the change for February 1.9%.

- PNB share target for March 2025. In the beginning at 212 Rs. Maximum 240, minimum 204. The averaged price 220. Punjab National Bank at the end of the month 222 Rs, the change for March 4.7%.

- PNB share price prediction for April 2025. In the beginning at 222 Rs. Maximum 270, minimum 222. The averaged price 241. Punjab National Bank at the end of the month 250 Rs, the change for April 12.6%.

- PNB share target for May 2025. In the beginning at 250 Rs. Maximum 279, minimum 237. The averaged price 256. Punjab National Bank at the end of the month 258 Rs, the change for May 3.2%.

- PNB share price prediction for June 2025. In the beginning at 258 Rs. Maximum 284, minimum 242. The averaged price 262. Punjab National Bank at the end of the month 263 Rs, the change for June 1.9%.

- PNB share target for July 2025. In the beginning at 263 Rs. Maximum 284, minimum 242. The averaged price 263. Punjab National Bank at the end of the month 263 Rs, the change for July 0.0%.

- PNB share price prediction for August 2025. In the beginning at 263 Rs. Maximum 293, minimum 249. The averaged price 269. Punjab National Bank at the end of the month 271 Rs, the change for August 3.0%.

- PNB share target for September 2025. In the beginning at 271 Rs. Maximum 302, minimum 258. The averaged price 278. Punjab National Bank at the end of the month 280 Rs, the change for September 3.3%.

- PNB share price prediction for October 2025. In the beginning at 280 Rs. Maximum 309, minimum 263. The averaged price 285. Punjab National Bank at the end of the month 286 Rs, the change for October 2.1%.

- PNB share target for November 2025. In the beginning at 286 Rs. Maximum 314, minimum 268. The averaged price 290. Punjab National Bank at the end of the month 291 Rs, the change for November 1.7%.

- PNB share price prediction for December 2025.

PNB Share Price Target 2030

| 2030 | Share Price Target |

|---|---|

| January | ₹200.00 |

| February | ₹195.00 |

| March | ₹198.00 |

| April | ₹202.00 |

| May | ₹205.00 |

| June | ₹208.00 |

| July | ₹210.00 |

| August | ₹205.00 |

| September | ₹215.00 |

| October | ₹218.00 |

| November | ₹220.00 |

| December | ₹225.00 |

PNB Share Price Target 2035

| 2035 | Share Price Target |

|---|---|

| January | ₹270.00 |

| February | ₹265.00 |

| March | ₹268.00 |

| April | ₹272.00 |

| May | ₹275.00 |

| June | ₹278.00 |

| July | ₹280.00 |

| August | ₹275.00 |

| September | ₹285.00 |

| October | ₹288.00 |

| November | ₹290.00 |

| December | ₹295.00 |

PNB Share Price Target 2040

| 2040 | Share Price Target |

|---|---|

| January | ₹340.00 |

| February | ₹335.00 |

| March | ₹338.00 |

| April | ₹342.00 |

| May | ₹345.00 |

| June | ₹348.00 |

| July | ₹350.00 |

| August | ₹345.00 |

| September | ₹355.00 |

| October | ₹358.00 |

| November | ₹360.00 |

| December | ₹365.00 |

Understanding PNB Share Price Dynamics

Exploring the intricate dynamics that influence PNB’s share price trajectory is essential for investors aiming to make informed decisions. Factors such as market trends, economic indicators, company performance, and industry analysis contribute significantly to price movements.

PNB, as a prominent player in the financial sector, is subject to both internal and external influences. Market sentiment, regulatory changes, technological advancements, and global economic conditions all intertwine to shape the prospects of PNB’s share price.

PNB’s stock (NSE: PNB, BSE: 532461) entered the stock exchange in 2002 and performed well until 2010. However, since then, it has experienced a downward trend. Between October 2010 and September 2013, it plummeted by over 60%. Subsequently, it surged 150% from September 2013 to December 2014 and declined 65% from 2014 to 2016. Following that, it rose by 165% from 2016 to 2017. However, since 2017, it has been on a downward trajectory, almost 60% down from its peak in 2010 and currently showing a 70% decrease.

Forecasting Methods Employed

Technical Analysis: Unveiling Patterns and Trends

Technical analysis involves scrutinizing historical market data to identify patterns and trends that could indicate future price movements. Chart patterns, such as support and resistance levels, moving averages, and momentum indicators, offer valuable insights into potential price targets.

Fundamental Analysis: Evaluating Company Performance

Fundamental analysis delves into the intrinsic value of a company by assessing its financial health, management team, competitive position, and growth prospects. By scrutinizing key financial metrics, such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE), investors can gauge the underlying value of PNB’s stock.

Sentiment Analysis: Gauging Market Sentiment

Market sentiment, often driven by investor emotions and perceptions, can significantly impact stock prices. Sentiment analysis involves monitoring social media trends, news sentiment, and investor sentiment indicators to gauge market sentiment accurately.

Read More: Analyzing Yes Bank’s Share Price Target for 2030

PNB Share Price Target 2025: Insights and Forecasts

Expert Prediction 1: Technical Indicators Point to Bullish Trend

Technical analysts anticipate a bullish trend for PNB’s share price leading up to 2025. With the stock exhibiting strong upward momentum and breaching key resistance levels, many analysts project a positive outlook for PNB’s future performance.

Expert Prediction 2: Fundamental Strengths Support Long-Term Growth

Fundamental analysts emphasize PNB’s robust financial position, diversified business model, and strategic initiatives as catalysts for long-term growth. With a focus on expanding its market presence and enhancing digital capabilities, PNB is poised to capitalize on emerging opportunities in the financial sector.

Expert Prediction 3: Market Sentiment Favors Optimism

Market sentiment towards PNB remains predominantly optimistic, fueled by favorable macroeconomic conditions and positive industry trends. As investor confidence continues to strengthen, PNB’s share price is expected to reflect this positive sentiment in the coming years.

FAQs (Frequently Asked Questions)

Q: What factors contribute to PNB’s share price volatility?

A: PNB’s share price volatility can be influenced by various factors, including market fluctuations, regulatory changes, economic indicators, and company-specific news.

Q: How can investors mitigate risks associated with investing in PNB?

A: Diversification, thorough research, risk management strategies, and staying informed about market developments can help investors mitigate risks associated with investing in PNB.

Q: Does PNB offer dividends to its shareholders?

A: Yes, PNB periodically distributes dividends to its shareholders, reflecting the company’s profitability and commitment to delivering value to investors.

Q: What are the potential growth drivers for PNB in the coming years?

A: Key growth drivers for PNB include expanding digital banking services, enhancing customer experience, strategic partnerships, and tapping into emerging market opportunities.

Q: How does PNB adapt to regulatory changes in the financial sector?

A: PNB maintains a proactive approach to regulatory compliance, staying abreast of changes in regulations and implementing necessary measures to ensure compliance while fostering innovation.

Q: Where can investors find reliable information about PNB’s financial performance?

A: Investors can access comprehensive financial reports, investor presentations, and updates on PNB’s official website or through reputable financial news outlets.

Conclusion

As investors navigate the dynamic landscape of financial markets, insights into PNB’s share price target for 2025 offer valuable guidance and perspective. By leveraging diverse analytical approaches and expert opinions, investors can gain a comprehensive understanding of the factors driving PNB’s future performance. With a forward-looking outlook and strategic foresight, investors can position themselves to capitalize on potential opportunities in PNB’s journey ahead.