Introduction to Menon Pistons

Menon Pistons Limited is a well-known player in India’s auto components industry, specializing in the production of pistons, piston rings, and other critical automotive parts. Today Price of Menon Pistons 84.42 INR. Established over five decades ago, Menon Pistons has built a solid reputation for its commitment to innovation, high-quality manufacturing, and operational efficiency. This article takes a close look at the company’s projected share price targets for the years 2024, 2025, 2030, 2035, and 2040, while evaluating the factors driving its growth and the investment potential.

Overview of Menon Pistons’ Business

Key Product Lines

Menon Pistons produces a wide range of automotive components, with a focus on high-performance pistons and rings. These products are crucial in the functioning of internal combustion engines, particularly in commercial vehicles and heavy-duty machinery.

Market Position and Competitors

Menon Pistons has a strong foothold in the Indian automotive components market, catering to domestic manufacturers as well as export markets. Its main competitors include global giants in the auto parts sector, but Menon Pistons has maintained a competitive edge by focusing on precision engineering and maintaining long-term relationships with major automakers.

Financial Performance of Menon Pistons

Recent Financial Reports

Menon Pistons has consistently delivered solid financial results, showing steady growth in revenue and profitability over recent quarters. The company’s performance has been driven by its ability to scale operations and manage costs efficiently, despite the challenges posed by global supply chain disruptions.

Profit Margins and Revenue Trends

Over the last few years, Menon Pistons has seen a steady rise in profit margins, thanks to a combination of operational efficiency and increasing demand for its high-quality products. The company’s revenue growth has been consistent, positioning it well for future expansion.

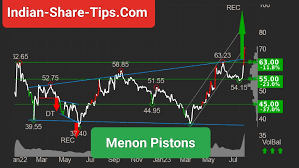

Menon Pistons’ Share Price History

Historical Stock Performance

Menon Pistons’ stock has shown moderate volatility, typical of auto-component manufacturers. However, the company has delivered long-term value to its shareholders, with periods of significant price appreciation following strong quarterly results and industry tailwinds.

Factors Impacting Share Price

Several factors impact Menon Pistons’ share price, including fluctuations in raw material costs, demand for automotive components, government policies, and the company’s own expansion efforts. The global shift towards electric vehicles (EVs) may also pose a challenge, as the demand for traditional internal combustion engine components could decrease over time.

Share Price Target for 2024

Predictions for 2024

For 2024, industry analysts expect moderate growth in Menon Pistons’ share price, fueled by strong demand for its products from the commercial vehicle sector. The company’s ongoing investments in capacity expansion and R&D are also expected to boost its market performance.

Key Growth Drivers in 2024

Key drivers of growth in 2024 will include increased demand from the automotive sector as economies recover post-pandemic, as well as Menon Pistons’ ability to expand its market share in export markets. The company’s emphasis on product innovation will also play a critical role in driving share price growth.

Share Price Target for 2025

| Year | Minimum Price | Maximum Price |

| 2025 | 4800 | 7800 |

| Month (2025) | Minimum Target | Maximum Target |

| January | Rs 5800 | Rs 6250 |

| February | Rs 5900 | Rs 6500 |

| March | Rs 6002 | Rs 6605 |

| April | Rs 6200 | Rs 6500 |

| May | Rs 6300 | Rs 6670 |

| June | Rs 6238 | Rs 6705 |

| July | Rs 6180 | Rs 6502 |

| August | Rs 6400 | Rs 6890 |

| September | Rs 6590 | Rs 6990 |

| October | Rs 6700 | Rs 7100 |

| November | Rs 6900 | Rs 7450 |

| December | Rs 7100 | Rs 7800 |

Expected Market Opportunities

By 2025, Menon Pistons is expected to benefit from continued growth in the commercial vehicle and heavy machinery sectors. Additionally, its ability to enter new international markets will be a significant opportunity for revenue growth, supporting a potential uptick in share prices.

Risks to Watch in 2025

Risks in 2025 include potential increases in raw material prices and the transition of the automotive industry towards electric vehicles. If Menon Pistons doesn’t pivot quickly to cater to this shift, it could face pressure on its traditional business segments.

Share Price Target for 2030

| Year | Minimum Price | Maximum Price |

| 2030 | 15000 | 28500 |

| Month (2030) | Minimum Target | Maximum Target |

| January | Rs 15550 | Rs 17500 |

| February | Rs 16500 | Rs 18500 |

| March | Rs 16050 | Rs 18890 |

| April | Rs 17500 | Rs 20200 |

| May | Rs 19990 | Rs 22500 |

| June | Rs 20560 | Rs 23650 |

| July | Rs 21450 | Rs 24650 |

| August | Rs 22650 | Rs 26500 |

| September | Rs 23540 | Rs 26578 |

| October | Rs 24650 | Rs 27980 |

| November | Rs 25650 | Rs 26530 |

| December | Rs 24560 | Rs 28500 |

Long-Term Outlook for the Industry

By 2030, the global automotive industry will likely see widespread adoption of electric vehicles, which could negatively impact traditional piston manufacturers. However, Menon Pistons may pivot to new business segments, such as EV components, to remain competitive in the evolving market.

Projected Growth Trajectories

Menon Pistons is expected to maintain stable growth through diversification into new markets and the development of alternative products. By 2030, its share price could reflect this transition, with gradual price appreciation as the company adapts to industry changes.

Share Price Target for 2035

Industry Changes and Technological Advancements

By 2035, advancements in automotive technology, including electric and autonomous vehicles, will likely disrupt the traditional auto-components industry. Menon Pistons will need to invest heavily in R&D to stay relevant and seize new opportunities.

Potential for New Markets

Menon Pistons could explore diversification into adjacent markets such as aerospace or specialized machinery. These industries may offer new revenue streams and help the company mitigate risks associated with the declining demand for internal combustion engine components.

Share Price Target for 2040

| Year | Minimum Price | Maximum Price |

| 2040 | 36000 | 48000 |

Speculative Forecasts for 2040

Forecasting Menon Pistons’ share price for 2040 is highly speculative. However, if the company successfully adapts to changing industry trends and continues to innovate, it could emerge as a key player in both traditional and alternative markets, potentially leading to significant stock price appreciation.

Future Industry Trends

By 2040, the automotive components industry may see widespread automation, 3D printing, and alternative energy-powered machinery. Menon Pistons will need to align with these trends to remain a strong contender in the market, especially as the demand for green energy solutions grows.

Investment Strategies for Menon Pistons

Short-Term vs. Long-Term Approaches

Short-term investors may benefit from periodic price fluctuations due to Menon Pistons’ ongoing business expansion. However, long-term investors should focus on the company’s adaptability and strategic positioning for future growth in an evolving industry.

Risk Management for Auto Component Investments

Investors should monitor the company’s transition towards newer, sustainable markets and evaluate potential risks, such as raw material price fluctuations and global economic downturns. Diversification in portfolios may also help mitigate the risks associated with the automotive sector’s transition to electric vehicles.

Conclusion

Menon Pistons is a strong player in the auto-components market, with a solid business model and consistent financial performance. While the company faces challenges due to the shifting automotive landscape, its focus on innovation and diversification could secure its future. Investors should closely monitor its strategic decisions and market adaptability as the industry evolves.

FAQs

What drives Menon Pistons’ share price?

Menon Pistons’ share price is driven by demand for its products, raw material costs, global market trends, and the company’s financial performance.

Is Menon Pistons a good investment for the future?

Menon Pistons shows potential as a long-term investment, especially if it successfully adapts to changing industry trends and continues to innovate.

What challenges does Menon Pistons face?

Key challenges include rising raw material prices and the shift towards electric vehicles, which could reduce demand for traditional auto components.

How is Menon Pistons positioned in the global market?

Menon Pistons has a growing international presence, with exports contributing significantly to its revenue.

Where can I track Menon Pistons’ stock price?

You can track Menon Pistons’ stock price on major financial platforms such as the NSE or BSE.